The trading floor is a myth for most modern analysts. The real floor is a sea of glowing monitors, each one a portal to a relentless torrent of information. Pre-market opens, and the deluge begins: overnight earnings reports from Asia, breaking geopolitical news from Europe, fluctuating futures, and a flood of SEC filings. For a human analyst, the task is Sisyphean—to sift, sort, and synthesize this mountain of data into a single, coherent, actionable insight before the opening bell. It’s a race against time where a single missed detail can mean the difference between profit and loss. The pressure is immense, and the tools, often, are inadequate. Standard dashboards show you the what, but rarely the why or the what if. You can ask a basic AI assistant for a stock price, but can it reason about a company’s position based on a new patent filing cross-referenced with its latest earnings call transcript? For the most part, no.

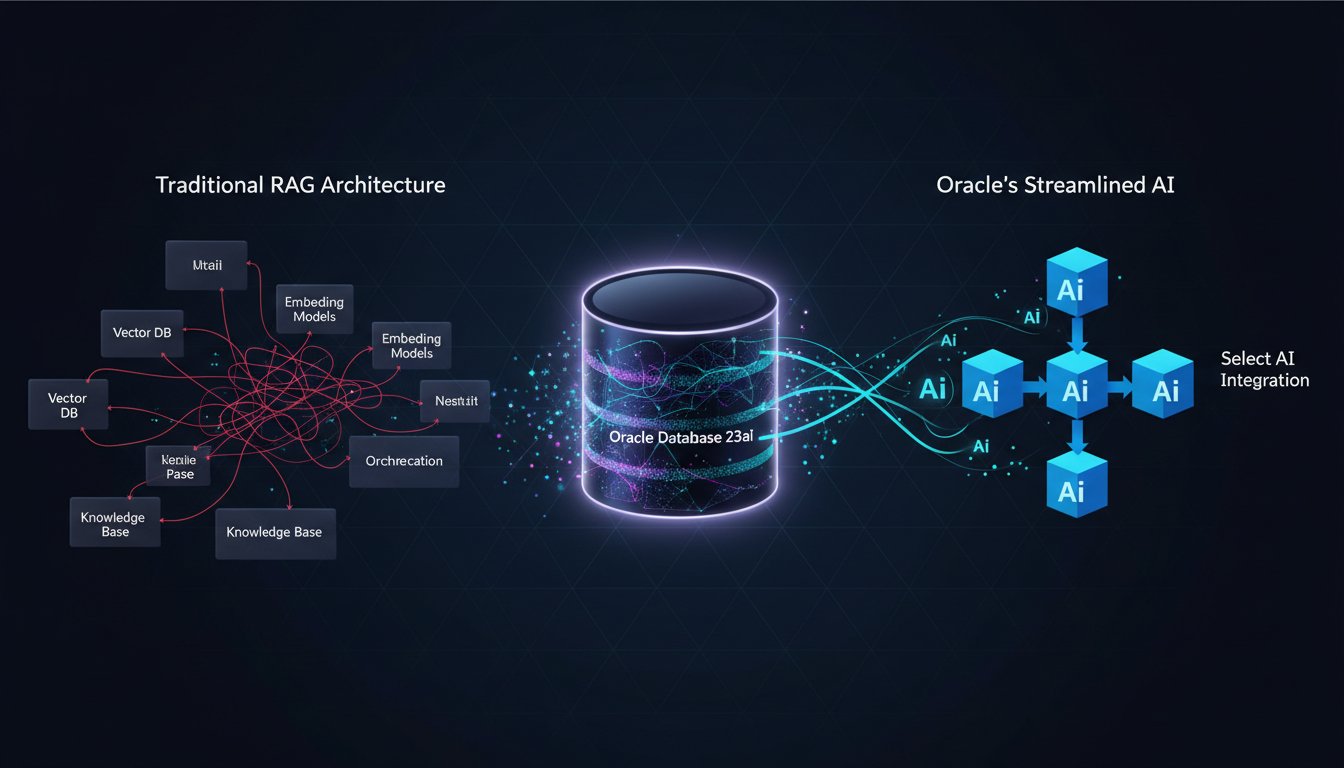

This is the critical challenge where traditional AI, even systems powered by standard Retrieval-Augmented Generation (RAG), falls short. RAG is excellent at pulling factual information from a known knowledge base. It can tell you what a company’s P/E ratio is or summarize a news article. But in the high-stakes world of finance, simple retrieval isn’t enough. Analysts need a partner that can think, strategize, and proactively connect disparate dots. They need an assistant that doesn’t just fetch information but understands the underlying intent of a query, forms a plan to gather multistep evidence, and delivers a nuanced, data-driven perspective. The limitation of older models is their static nature; they answer what they are asked from the documents they are given, but they cannot dynamically seek out new information or reason about its implications.

The solution lies in a more advanced, more dynamic paradigm: Agentic RAG. This isn’t just an incremental update; it’s a leap forward in AI capability. An agentic system can decompose a complex question like, “What are the biggest risks to NVIDIA’s market share this quarter?” into a series of sub-queries. It can then execute a plan, tapping into real-time market data APIs, scanning news feeds, and querying internal vector databases of financial reports to build a comprehensive answer. It moves beyond simple retrieval to active, intelligent investigation. This article will serve as your technical blueprint for building such a system. We will walk through the architecture of an Agentic RAG financial analyst, from data ingestion to the agentic reasoning core, and cap it off by giving your analyst a voice using ElevenLabs, transforming raw text into a conversational intelligence partner. Get ready to move beyond basic Q&A and build an AI that truly analyzes.

The Core Problem: Why Traditional RAG Fails in Finance

For generative AI to be truly transformative in the enterprise, it must move beyond simple document question-and-answer. While traditional RAG was a groundbreaking step in connecting Large Language Models (LLMs) to factual, proprietary data, its architecture reveals critical limitations when faced with the dynamic, complex, and time-sensitive demands of financial analysis.

The Static Knowledge Bottleneck

Standard RAG architectures are fundamentally reactive. They operate on a pre-indexed, static corpus of information. An LLM’s response is only as good as the context it’s provided, which is retrieved from a vector database. This works well for stable knowledge bases like company HR policies or technical manuals.

In finance, however, the knowledge base is anything but stable. Market conditions change by the millisecond. A company’s valuation can be reshaped by a single news event or a competitor’s earnings call. A traditional RAG system, relying solely on its indexed data, is always looking in the rearview mirror.

Lack of Reasoning and Proactive Analysis

The most significant drawback is the inability to reason or plan. A traditional RAG model retrieves relevant chunks of text but cannot formulate a multi-step strategy to answer a complex question. It’s a librarian, not a detective.

As Nicola Sessions, Director of Product Marketing for NVIDIA, aptly puts it, “Traditional RAG is good for retrieving facts, but it’s not smart enough to reason or plan. Agentic RAG, on the other hand, can dynamically retrieve and process information to have a conversation and get things done.” This distinction is crucial. An analyst doesn’t just want data; they want insights derived from that data. An agentic system can understand that answering a question about market risk requires checking stock performance, analyzing recent news sentiment, and reviewing analyst reports—a task far beyond the scope of simple vector search.

Architecting Your Agentic Financial Analyst

Building an Agentic RAG system requires a conceptual shift from a linear pipeline (Retrieve -> Augment -> Generate) to a cyclical, intelligent loop (Plan -> Act -> Observe -> Refine). This loop allows the AI to behave like a human researcher, continuously adapting its strategy based on the information it discovers.

The Agentic RAG Framework: A Blueprint

At its core, an agentic framework consists of an LLM-powered agent that has access to a set of “tools.” The agent’s job is to intelligently decide which tools to use, in what order, to fulfill the user’s request.

Here’s the flow:

1. Plan: The agent receives a complex query (e.g., “Analyze the impact of the latest interest rate hike on tech growth stocks.”). It breaks the query down into a logical sequence of steps.

2. Act: The agent executes the first step by selecting and using a tool. This could be querying a vector database, calling a live stock price API, or performing a web search.

3. Observe: The agent receives the output from the tool. This new information becomes part of its working context.

4. Refine & Repeat: The agent assesses the new information. Has the question been answered? If not, it refines its plan and moves to the next step, repeating the Act-Observe cycle until a comprehensive answer is formulated.

Key Components and Tool Selection

Choosing the right components is critical for building a robust financial analyst agent.

- Large Language Model (LLM): You need a model with strong reasoning and function-calling capabilities. Models like OpenAI’s GPT-4, Anthropic’s Claude 3, or Meta’s Llama 3 are excellent choices.

- Vector Database: This will house your private, long-term knowledge, such as indexed SEC filings, earnings call transcripts, and internal research notes. Options like Pinecone, Chroma, or Weaviate are industry standards.

- Real-Time Data APIs: To provide live market context, you must integrate tools that can access up-to-the-minute information. APIs like Alpha Vantage for stock data, NewsAPI for headlines, or Polygon.io for comprehensive market data are essential.

- The Agentic Layer: This is the software that orchestrates the entire process. Frameworks like LangChain and LlamaIndex provide powerful, high-level abstractions for building agents, defining tools, and managing the reasoning loop.

Step-by-Step Implementation Guide

Let’s translate the architecture into a practical, high-level implementation plan. We’ll use Python with the LangChain framework as our example.

Step 1: Setting Up Your Data Ingestion Pipeline

First, you need to populate your vector database. You can write scripts to automatically pull and process documents from sources like the SEC’s EDGAR database for 10-K and 10-Q filings. As you ingest these documents, you’ll use an embedding model to convert them into vectors and store them in your chosen vector database.

Step 2: Building the Reasoning Engine (The “Agent”)

Using LangChain, you can define a set of tools that your agent can use. Each tool is essentially a Python function with a clear description of what it does. This description is vital, as the LLM uses it to decide when to call the tool.

Example Tool Definitions (Pseudo-code):

# Tool to get the latest stock price

def get_stock_price(ticker: str) -> float:

"""Returns the current stock price for a given ticker symbol."""

# API call to Alpha Vantage

...

# Tool to search recent news

def search_financial_news(query: str) -> list[str]:

"""Searches for recent financial news articles related to a query."""

# API call to NewsAPI

...

# Tool to query internal research documents

def query_research_database(query: str) -> str:

"""Searches our internal vector database of earnings calls and reports."""

# Vector search query

...

Once you have your tools, you initialize an agent in LangChain, passing it the LLM and the list of tools. The framework handles the complex logic of the Plan-Act-Observe loop behind the scenes.

Step 3: Dynamic Information Retrieval

This is where the magic happens. When a user asks, “Is Apple a good buy right now?” the agent doesn’t just search for the phrase “good buy.” It forms a plan:

1. Thought: “First, I need to get the current stock price for AAPL.”

* Action: Calls get_stock_price('AAPL').

2. Thought: “Next, I should check recent news for any major events related to Apple.”

* Action: Calls search_financial_news('Apple Inc.').

3. Thought: “Finally, I should review our internal analysis from the latest earnings call.”

* Action: Calls query_research_database('Key takeaways from Apple Q4 earnings call').

Step 4: Generating the Analytical Response

After executing its plan, the agent collects all the retrieved information—the stock price, news headlines, and internal analysis. It then sends this rich, aggregated context to the LLM in a final prompt, asking it to synthesize the data into a single, coherent analytical response for the user.

Bringing Your Analyst to Life with a Voice

Raw text output is functional, but a voice interface creates a truly interactive and accessible experience. An analyst can receive briefings while commuting or multitask more effectively by listening to insights instead of reading them.

Why Voice Matters for Financial Insights

In a fast-paced environment, hands-free operation is a significant advantage. A voice-based AI assistant allows for a more natural, conversational flow of information. It reduces screen fatigue and makes complex data feel more approachable and personal, transforming the tool from a simple program into an active partner in the analysis process.

Integrating ElevenLabs for Realistic Audio

Once your agent generates the final text-based analysis, you can pass it to a high-quality text-to-speech (TTS) API to create the audio output. ElevenLabs is a leader in this space, offering incredibly realistic and low-latency voice generation that is perfect for this application.

Integrating it is simple. After receiving the final text from your agent, you make an API call to ElevenLabs:

import requests

ELEVENLABS_API_KEY = "your_api_key_here"

final_analysis_text = agent.run("Analyze the impact of the latest interest rate hike...")

response = requests.post(

f"https://api.elevenlabs.io/v1/text-to-speech/your_voice_id",

headers={

"Accept": "audio/mpeg",

"Content-Type": "application/json",

"xi-api-key": ELEVENLABS_API_KEY

},

json={

"text": final_analysis_text,

"model_id": "eleven_multilingual_v2",

"voice_settings": {"stability": 0.5, "similarity_boost": 0.75}

}

)

with open('financial_briefing.mp3', 'wb') as f:

f.write(response.content)

To create a realistic and engaging voice for your financial analyst, you’ll need a powerful text-to-speech API. We recommend ElevenLabs for its high-quality, low-latency audio generation. Click here to sign up for ElevenLabs and start building your own voice-based AI applications.

We’ve journeyed from the limitations of traditional RAG to the immense potential of an agentic system that can reason, plan, and act. By empowering an LLM with a suite of tools for real-time data access and internal knowledge retrieval, you create an AI that doesn’t just answer questions but performs genuine analysis. Adding a lifelike voice with ElevenLabs is the final step, transforming a powerful data engine into an intuitive, conversational partner.

Now, imagine that pre-market chaos again. But this time, instead of frantically searching, you simply ask: ‘What are the key risks and opportunities for NVIDIA today?’ and get a clear, audible briefing in seconds. That’s the power you just learned how to build. The financial world moves fast, and your tools must evolve to keep pace. Building an agentic analyst is a significant step towards creating truly intelligent, responsive systems. This isn’t just a theoretical exercise; it’s the future of enterprise AI. Start building your own intelligent agents today and see the transformative impact for yourself.